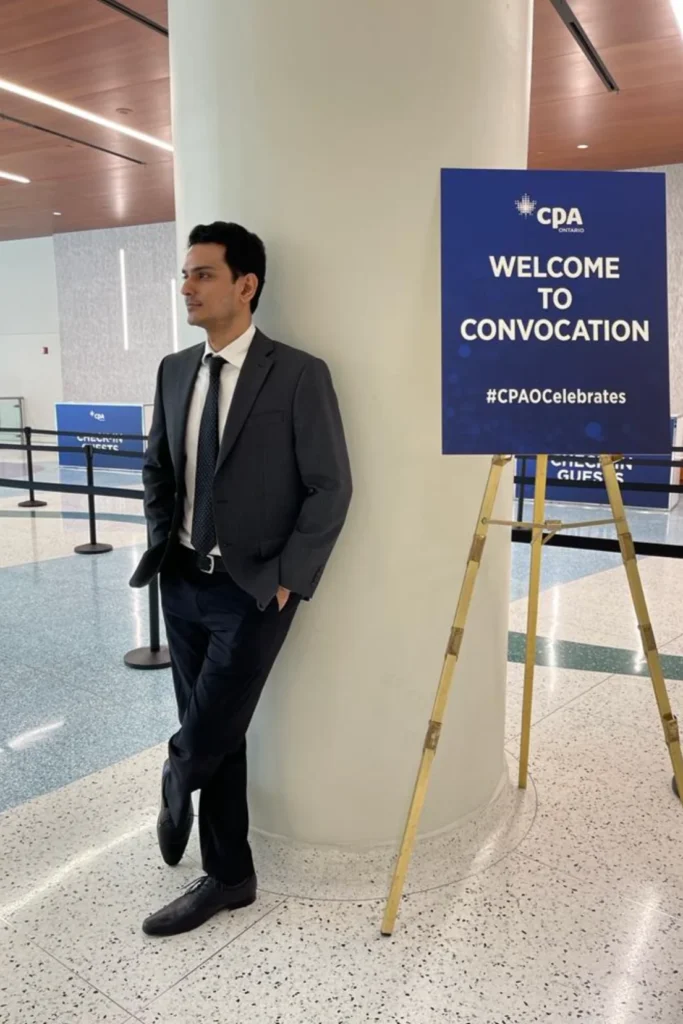

Taimur Saad, CPA brings over 15 years of extensive experience in accounting, taxation, and financial advisory services. Throughout his career, he has held key roles at prominent organizations, including Hydro One, CBRE, The Hudson’s Bay, Enercare, and BGIS, where he honed his expertise in financial management, process optimization, and strategic planning.

As a CPA-designated professional, Taimur is also Tableau Certified and Six Sigma Certified, reflecting his commitment to delivering efficient, data-driven, and results-oriented solutions. His diverse experience spans corporate accounting, tax planning, compliance, and financial analysis, positioning him as a trusted advisor to businesses across various industries.

Taimur has successfully supported small businesses, large enterprises, and entrepreneurs by streamlining their accounting processes, optimizing tax strategies, and ensuring compliance with ever-changing regulations. His proactive approach helps clients maximize profitability, minimize tax liabilities, and achieve their financial goals with confidence.

With a strong focus on client satisfaction, Taimur goes above and beyond to provide personalized, detail-oriented service. He takes the time to understand each client’s unique challenges and tailors solutions to meet their specific needs. Whether it’s managing complex tax filings, implementing efficient bookkeeping systems, or advising on business growth strategies, Taimur brings clarity, expertise, and unwavering dedication to every client relationship.

Taimur’s deep understanding of Canadian tax laws and financial systems, combined with his ability to leverage cutting-edge accounting technologies, allows him to provide innovative solutions that drive results. He has extensive experience handling areas such as corporate tax filings, HST/GST compliance, payroll management, leasehold improvement accounting, and financial reporting, making him an invaluable resource for clients seeking to navigate complex financial landscapes.